|

C8 Technologies is pleased to announce that seven Trendrating indices will now be available through the C8 platform. The strategies will be available to C8 clients to be accessed through a direct index and will be fully included in C8 Studio and thus available to be combined with other strategies and allocations optimized to create complete portfolio solutions for clients. The indices are: Trendrating US Tech Index, Trendrating US 100 Index (Mega Cap), Trendrating US 500 Index (Large Cap), Trendrating Europe 50 Index (Mega Cap), Trendrating US 600 Index, Trendrating Value & Growth US SMID 30, and Trendrating Value & Growth Large Cap 30. “We have long been an admirer of Trendrating’s research tools”, says Craig Cmiel, Head of C8 US, “and now we are excited to bring their indices and solutions to US advisors as well as our international clients.” Trendrating is the leader in trend capture models, analytics, and technology, serving hundreds of asset managers and financial advisors worldwide with partnerships that include Bloomberg and Euronext. Trendrating provides an innovative, well proven set of analytics to assess and rate the quality of price trends. The ability to capture trends, profit from bull markets, and avoid bear phases is the key to superior performance on a consistent basis. Trendrating makes it possible to quickly analyze trends using a rating system where A and B identify bull trends and C and D point to bear trends. This rating approach captures medium to long term price trends in a systematic and unbiased way that can impact yearly portfolio returns. The Trendrating indices combine the best fundamentals with an intelligent trend validation filter. They are designed to profit from performance dispersion across each given stock universe. Rocco Pellegrinelli, CEO of Trendrating commented that “We are delighted to partner with C8 and make our innovative indices available to asset managers and investment advisors. We see a growing demand for indices and strategies that can better manage the new market regime and we believe that profiting from the performance dispersion across stocks requires advanced analytics that provide an edge in discovering and capturing price trends.” |

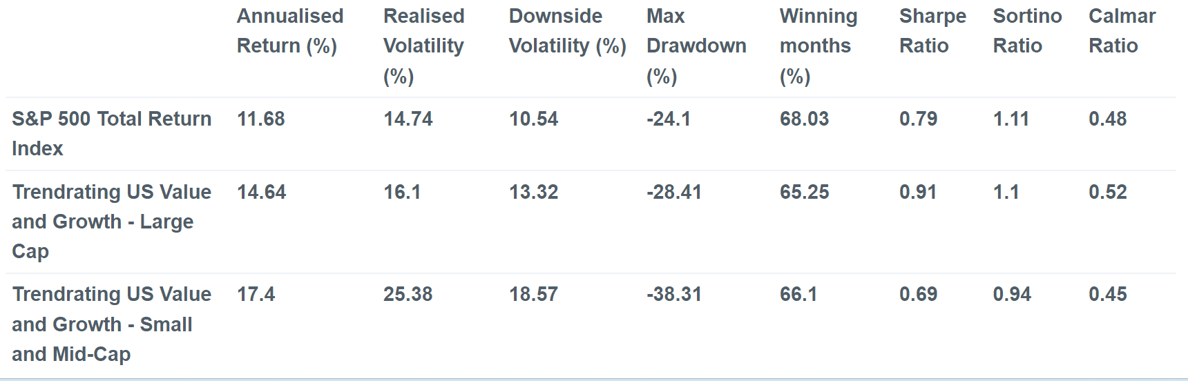

C8 Studio: Trendrating US Value and Growth vs S&P 500 |

|

|

|

Trendrating examines the US Large Cap or Small to Mid-Cap stock universe for stocks with a low price to sales ratio (value) and a high 3 mth sales growth (growth). For each index they then use their proprietary metrics to select the top 30 stocks in terms of upward price momentum. As can be seen above, Trendrating’s US Value and Growth indices for both Large Cap and Small and Mid-Cap comfortably outperform the S&P500 over the past 10 years. Notably, both indices avoided the large 2022 drawdown in US equities, ending broadly flat in the Large Cap and up 17% in the Small to Mid-Cap. |