|

Over the month since our C8 Weekly Bulletin highlighted early signs of an opening up of the Chinese economy, the liberalisation steps have gathered new momentum. Against this backdrop, the timing may be propitious for Cirdan Capital’s launch today of the C8 China Futures Access certificate. |

China – Easing of Covid Restrictions and Property Sector Support |

|

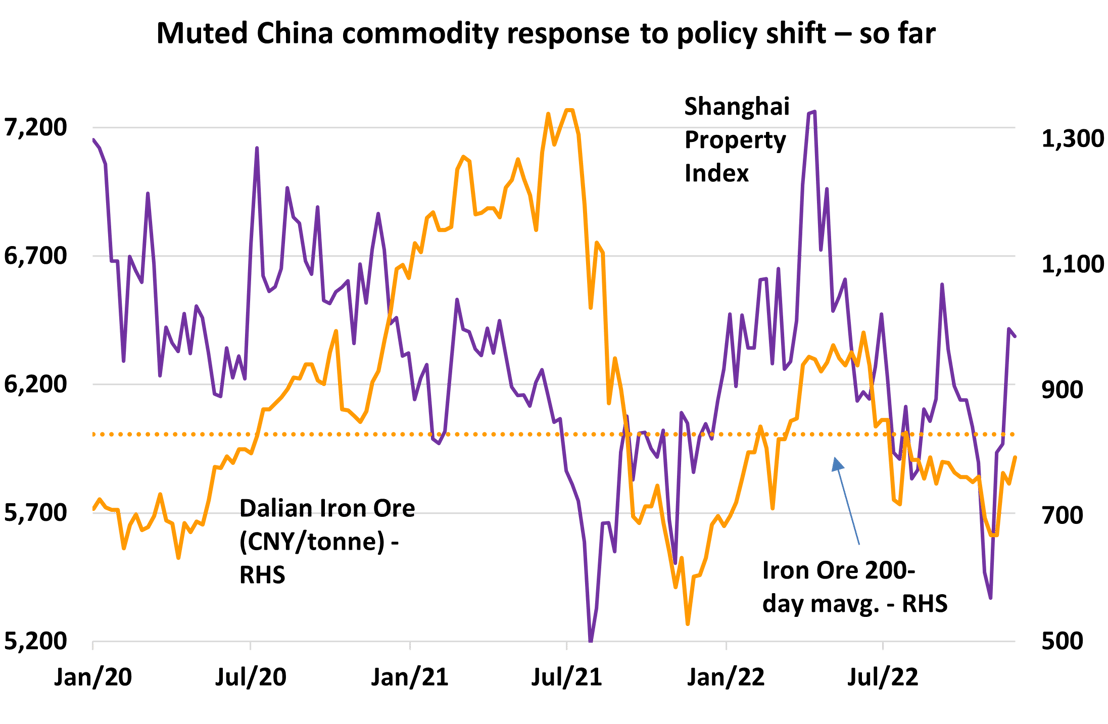

More than a dozen cities have eased COVID rules with a relaxation of both testing and quarantine restrictions. Extended sector-wider lockdowns have finally been abandoned. Against this backdrop, the Shanghai Composite has gained a 4.5% while the Hang Seng Index added a substantial 17.6%. The more benign COVID-policy backdrop has been reinforced by very substantial, wide-ranging steps to boost China’s property sector. In a year’s worth of policy initiatives packed into a just a few weeks, major banks are reported to have set aside USD 162bn in new credit support for property developers (alongside new offshore and equity funding for the sector) while banks ease borrowing rules for housebuyers more widely. On the property sector policy news, the CSI 300 Real Estate Index jumped 9.4% – the biggest one-day advance on record – and the Shanghai Property Index has climbed by a fifth in past month. But amid the equity market volatility, the response in the commodity complex – so far – has been rather muted (Dalian’s front contract iron ore still languishes below the 200-day mavg, see chart). Given the role of construction in driving domestic commodity demand (it accounts for over half of domestic steel consumption) this may simply be the lull before the 2023 volatility storm! |

|

China Futures Access Certificate Launches |

|

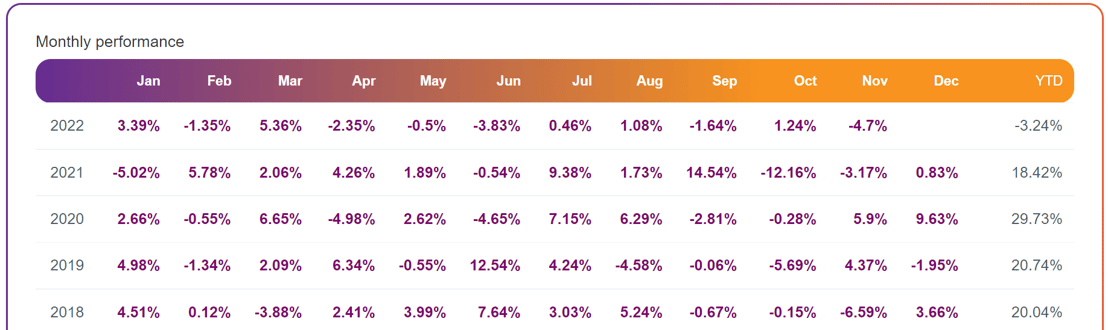

Against this backdrop of liberalisation, and economic support, the timing is propitious for Cirdan Capital to be launching the C8 China Futures Access certificate today. The certificate (ISIN XS2559387977) is denominated in EUR and listed on the Frankfurt Börse, or available directly by private placement at NAV. The China futures markets have developed over the past 30 years into some of the largest and most influential futures markets globally, trading traditional as well as esoteric contracts. Historically, regulatory controls have prevented offshore investors gaining exposure to the uncorrelated returns that this highly liquid, yet still inefficient, market can offer. Recent regulatory changes have allowed global investors some limited access to these interesting markets, however, most new capacity has been filled by large institutional investors. C8 is relatively unique in its position of being independent and well-established in the Chinese market with a 4+ year track record and local presence, with capacity available to offer to investors and managers alike. The strategy has been live in China since 2018, generating a Sharpe Ratio of 1.4 with low correlation to other asset classes (including Chinese equities) making it particularly appealing as a portfolio diversifier. |

|

|

|