|

|

|

C8’s Weekly Bulletin: Giving Investors an Edge20 September 2022 |

|

Welcome to our first issue of the C8 Weekly Bulletin. With many years of market experience across all major asset classes, we at C8 believe there are real benefits from having a concise overview of key economic and policy developments, whatever the specific investment approach. We are happy to share this overview with our clients and partners, and, when appropriate, highlighting indices on C8 Studio which resonate with the current market environment. We hope that you find this useful, and we look forward to receiving feedback. As it may not be for everyone, we have an unsubscribe option at the end |

Central banks meet amid forecast failures |

|

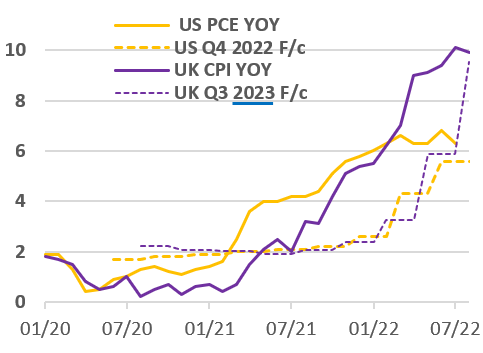

Two major central banks – the US Federal Reserve and Bank of England – meet this week to recalibrate policy rates in the context of persistent upside inflation surprises in headline inflation. FOMC projections for PCE inflation at the end of this year had doubled in H1 2022 (to 5.2%) but the still lags well behind the latest reading of 6.3% y/y. Perhaps more remarkably, BoE forecasts for CPI inflation in late 2023 (when Ukraine-linked price volatility should have dropped out of the calculation) have climbed from 2.4% to 3.25%…….to 5.9% and then to 9.5% over the past four monetary policy reports! Both central banks are likely to boost rates this week (by 75ps and 50bps, respectively) and the lack of visibility on inflation creates substantial uncertainly over the extent of further policy tightening. |

|

|

Fed Chair Powell recently argued that in tackling inflation the Fed “must keep at it until the job is done” – a phrasing which echoed Paul Volcker’s memoir title “Keeping at it”. While the Fed may be successful in avoiding the necessity of Volcker-style interest rates, the Fed policy required to prevent that outcome may be a threat to global risk appetite, and risky assets, in coming quarters. |

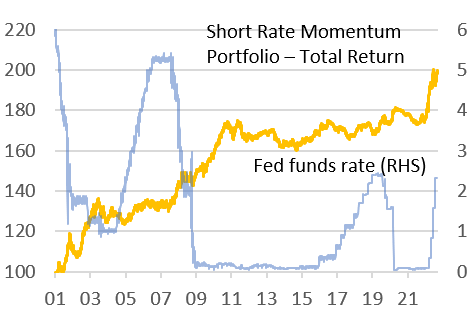

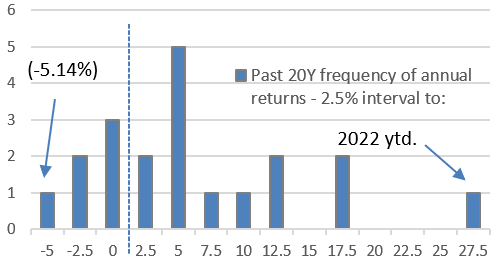

Short Rates portfolio as diversificationRates Momentum – Short Rates portfolio may offer valuable diversification in this context. The portfolio trades short interest rate futures across three markets – EuroDollar, Euribor and Short Sterling (and across second to eighth nearby contracts in each market). It assess momentum based on relative strength indicators and overall market directional exposure reflects the balance between positive and negative signals. Amid central bank policy divergences the net directional exposure would tend to be modest. Given this construction, it is not too surprising that the portfolio has prospered amid the unexpectedly aggressive tightening of monetary policy across the Fed, ECB and Bank of England. After failing to make net headway during unconventional monetary policy/COVID, the portfolio’s total return has climbed by 26.9% year-to-date. |

|

|

If sustained, this extends a 20Y pattern of large annual gains in the right policy context (and modest losses in unfavourable ones). Note that individual futures positions are risk/volatility adjusted to improve the stability of overall portfolio outturns. |

|