Market Recap

In what some have identified as an emerging pattern, President Trump used Wednesday to rattle markets, this time with speculation regarding a crackdown on advanced chip sales to China, putting pressure on chipmakers. If that pattern holds, we should expect to see some revised, lighter messaging by Friday or over the weekend. The rest of the markets saw declines as the latest Fed meeting minutes held that “the staff continued to view the risks around the inflation forecast as skewed to the upside“, and that “inflation would prove to be more persistent than the baseline projection assumed.” Overall, the messaging was that “the committee was well positioned to wait for more clarity on the outlook for inflation and economic activity” meaning they don’t seem to be in any rush to change rates.

The net effect of yesterday wasn’t a rush for the exits and in a relatively rare result, Mag 7 and technology names didn’t seem to play an outsized role in broad market index returns. The Nasdaq Composite fell 0.51%, the S&P 500 0.56%, and the Dow 0.58%. Small caps fell most as the Russell 2000 shed 1.08%. Since zero is considered a positive number all sectors except Real Estate (0.00%) ended the day lower, ranging from -0.02% (Communication Services) to -1.40%(Utilities). The Cboe Market Volatility Index (VIX) inched up to close at 19.31 and we saw gold drop 1.02% to $3,267.00/oz.

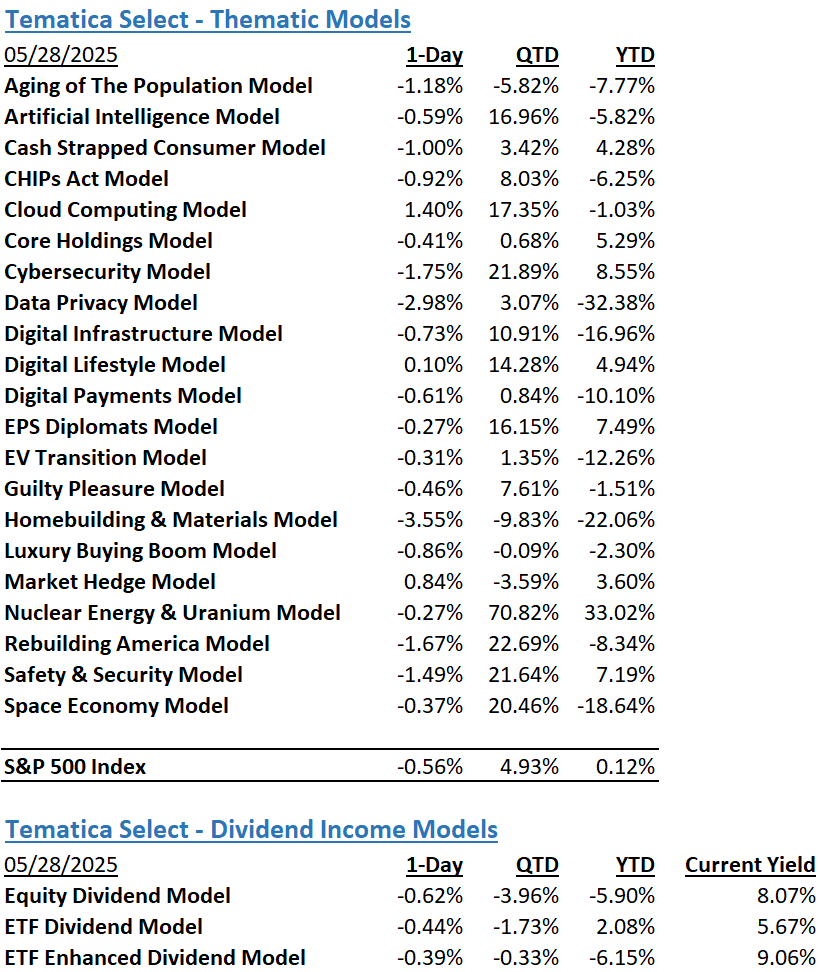

The Tematica Select Model Suite saw most strategies give back some gains but once again, Market Hedge wasn’t the only strategy to see gains in an overall down day as Cloud Computing and Digital Lifestyle ended higher by yesterday’s close. Strategies taking the biggest hits included Data Privacy and Homebuilding & Materials.

Enjoy the Court’s Tariff Ruling, Brace for Trump’s Response

Futures point to a jump higher when US equity markets open later this morning following. The catalyst for that was the late Wednesday night ruling from a federal trade court that struck down the “reciprocal” tariffs that Trump imposed on what he called “Liberation Day,” putting an immediate stop to the collection of a sweeping set of levies that the president imposed. A panel of three judges gave Trump’s team 10 days to halt tariff collection in a decision that the White House has already appealed.

While we suspect that ruling no doubt brings a wry smile to more than a few faces, we are bracing for what we can only be called “the Trump response”. Analysis from Goldman Sachs (GS) points to the court ruling as a “temporary setback” for Trump’s trade agenda as the president can use other tools to impose tariffs. Our thought is that while the market cheers the court ruling today, it should prepare for another bout of uncertainty as Team Trump responds.

Bringing a helping hand to a sizable move in US equity futures is the market reaction to Nvidia’s (NVDA) April quarter results. The company once again topped market consensus forecasts led by its Data Center business, which catapulted higher by more than 70% year over year. For the current quarter, Nvidia guided its top line to $44.10-$45.90 billion, sidestepping the $45.92 billion consensus forecast by sharing that its guidance reflects a loss in H20 revenue of approximately $8 billion. As one might suspect, we are seeing a fresh wave of NVDA price target increases this morning, with Piper Sandler, Citi, and BofA upping theirs to $180. As we think about that, let’s remember that NVDA shares account for ~6% of the S&P 500 and more than 11% of the Nasdaq 100 (NDX).

On the earnings front this morning, we have results from Best Buy (BBY), Hormel Foods (HRL), and Kohl’s (KSS) this morning. There is an even larger docket after the market close that will round out comments on the consumer, AI and data center, and cybersecurity as we hear from American Eagle (AEO), Costco (COST), Dell (DELL), Elastic (ESTC), Gap (GPS), Marvell (MRVL), Ulta Beauty (ULTA), and Zscaler (ZS).

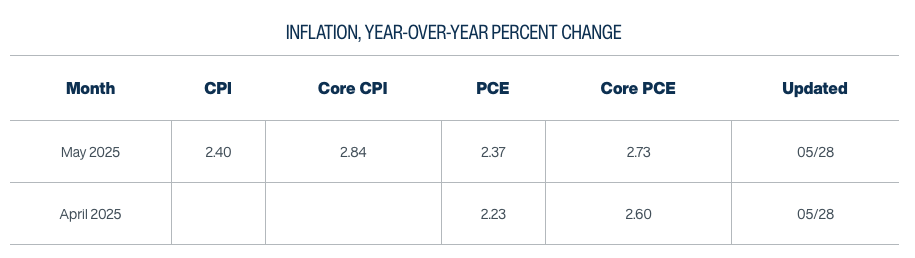

That will about do it for earnings reports as we close out May, but before we shut the door on the second month of the current quarter, tomorrow brings the April PCE Price Index data. Ah yes, one of the Fed’s favorite gauges of inflation, but given the timing of the data, tariffs, and more recently companies sharing the need to lift prices to offset the impact of tariffs, we’re not inclined to give that report a lot of weight. Adding to our thoughts on that was the pricing surge contained in S&P Global’s (SPGI) Flash May PMI report.

We see next week’s May ISM PMI data and what it reveals as being far more meaningful. But candidly, even the Cleveland Fed’s Inflation Nowcasting Model expects to see May inflation figures come higher than those for April. Not good for those expecting the Fed to deliver three rate cuts this year, and that eventual expectation reset gives us reason to think market volatility will be with us at least through July if not longer.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.