Market Wrap

What a difference a 30-minute conversation with fed chair Powell can make! In his answers to reporters’ questions following the Fed’s latest policy decision, he emphasized the 30,000-foot view the Fed has over the economy stating several times that while there may be pockets of pain in the economy, he doesn’t yet see pain as a widespread phenomenon. Further, his comments about what some perceive to be anomalies in the employment picture seemed to placate worriers. Finally, his comments about sentiment surveys boiled down to him effectively saying “I’m sorry you feel that way, but until I see it in the data, it’s not happening.” All these observations essentially drive home that the Fed remains data-dependent, despite him not uttering those exact words.

While some individual names could have had better days, like Intel (INTC), Progressive Corporation (PGR), and Gilead Sciences (GILD), markets were higher across the board. Small caps led the way as the Russell 2000 gained 1.57%. Technology exposure, specifically Mag 7 and related names were additive as evidenced by the Dow rising 0.92%, the S&P 500 adding 1.08%, and the Nasdaq Composite closing 1.41% higher.

Sectors were technically all positive since zero is considered by non-math majors to be a positive number, which is what Consumer Staples posted at the close. After a few down days, yesterday saw Amazon (AMZN) and Tesla (TSLA)contribute to just under 45% of that sector’s 1.92% result. Remaining sectors’ returns ranged from 1.63% (Energy) to 0.05% (Healthcare). With a 19.90 close, the Cboe Market Volatility Index (VIX) continued to moderate but still remained well above the long-term average, and gold was nudged 0.43% higher, to close just over $3,047/oz.

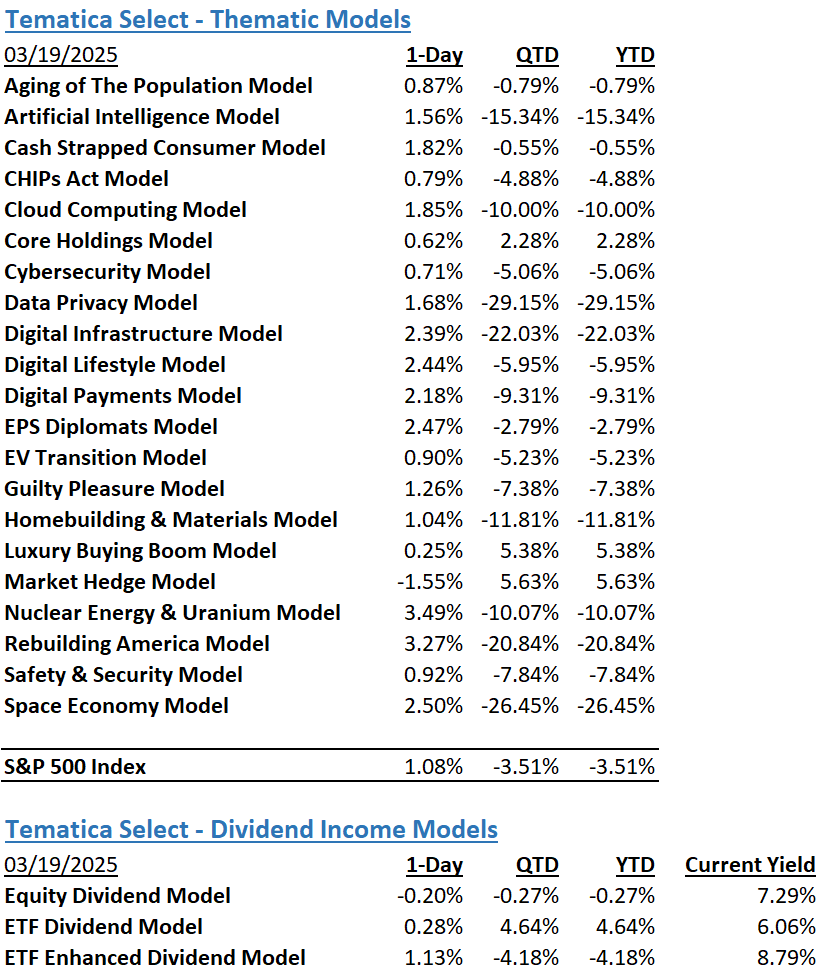

The Tematica Select Model Suite had a strong day across the board except for Luxury Buying Boom which saw some weakness as traders stepped in to “sell the news” after at least one luxury goods provider posted healthy results and an increased dividend. Otherwise, leadership came from Nuclear Energy & Uranium and Rebuilding America, followed by Space Economy and EPS Diplomats.

Nike, FedEx, and Micron: Setting the Tone for Q2 2025 Guidance

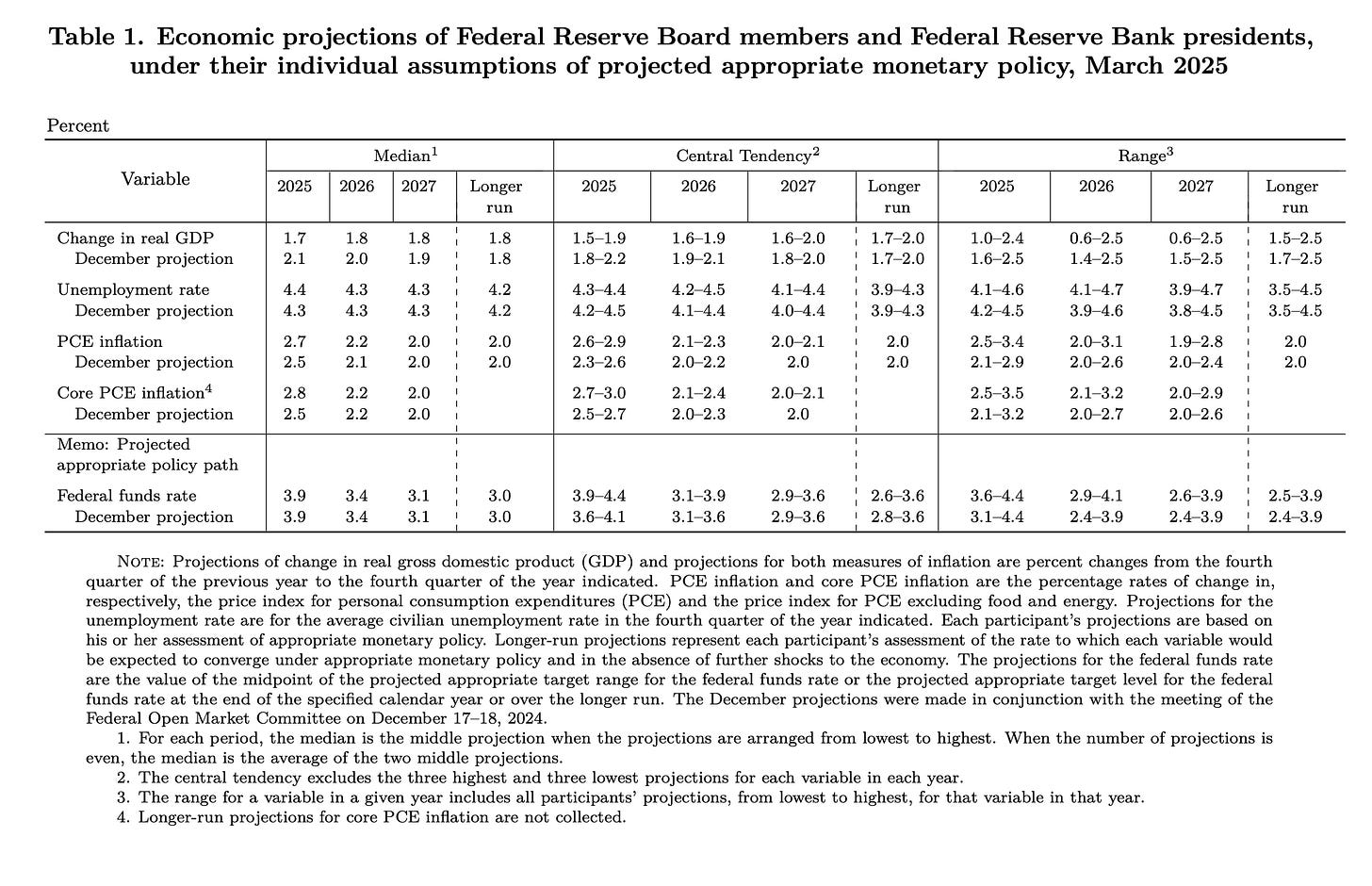

Equity futures point to a higher market open later this morning following yesterday’s post-Fed policy decision move. Our takeaway from parsing the Fed policy statement, the central bank’s updated set of economic projections, and the comments made during Fed Chair Powell’s presser is the Fed’s June policy meeting will be far more important than yesterday’s. While the Fed continued to forecast 50 basis points in cuts to the Fed funds rate this year, given recent inflation data, Powell’s comments the Fed wants to see more data to gauge the impact of tariffs and his conceding tariffs are likely to delay further progress on inflation, we suspect he was preparing the market for the likelihood the Fed delivers fewer cuts than those found in the March projections update.

Thinking about it, the Fed has six policy meetings left this year, with two more in 1H 2025. The timing associated with the next policy decision on May 7 means we probably won’t have a full picture of April tariffs, should they go into effect as is currently expected. That’s one reason to think the subsequent policy decision on June 18 will be more telling. By that time, we’ll start to have a clearer assessment of tariffs on the economy and job creation as well. That combination will be the one that allows the Fed to make a better determination on where monetary policy needs to be entering 2H 2025.

What that means for us is we will continue to digest oncoming data, looking to determine the vector and velocity of the economy and whether inflation is re-accelerating or getting back on track with regard to the Fed’s 2% target. The next data to focus on will be Monday’s Flash March PMI report from S&P Global (SPGI) followed by March facing data beginning on April 1. Around that time, we’ll also see if Trump’s reciprocal tariffs and ones on the US from the European Union move forward… or not.

As it relates to the market and the S&P 500, the next hurdle will be the aggregated forward guidance from FedEx (FDX),Nike (NKE), and Micron (MU) after today’s market close. Last week we discussed why we think the coming wave of June quarter guidance during the upcoming March quarter earnings season could underwhelm the market. What we hear from those three companies about the economy, tariffs, their respective end markets, and how that sizes up against consensus expectations will set the tone for what lies ahead.

If we’re right and consensus EPS expectations for Q2 2025 come down, it will likely trigger something similar to expectations for 2H 2025. These kinds of perception shifts have the potential to stir up investor questions about the market’s multiple. The re-setting of market expectations is never a fun time in the market, and this time around it could restrict the market’s rebound.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.