Market Recap

Pre-market futures activity was neutral to slightly lower ahead of the open on Nvidia (NVDA) and general AI/Data Center fears, and we saw a sideways-ish morning. That all changed around 1:30 pm when fed chair Powell remarked “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension…” from there, all bets were off. Mag7 sectors led the way lower with Consumer Discretionary, Communication Services, and Technology falling 2.47%, 2.69%, and 3.47%, respectively, helping pull the S&P 500 2.24% lower. Tech exposure dictated the pecking order yesterday as the Dow fell 1.73% and the Nasdaq Composite slid 3.07%. Small caps also fell but were held to a 1.03% decline.

As mentioned, Mag 7 sectors dropped most yesterday, and the remaining sectors saw returns between -0.05% (Real Estate) to -1.57% (Financials). Energy was the only sector to end the day higher, up 0.82% as both West Texas Intermediate (WTI) and Brent Crude (BRENT) gained around 1.50%. Gold continued to break new ground, closing in on $3.340/oz by the market close, and the Cboe Market Volatility Index (VIX) added 8.60% to close at 32.71.

The advance/decline line for holdings of the SPDR S&P 500 ETF Trust (SPY) was almost the exact opposite of our last update at 434/67. While the bad news is that SPY closed 2.22% lower, the less bad news (depending on your point of view) is that Mag 7 names only contributed to close to 55% of the fund’s results as opposed to other times when that figure was above 100%.

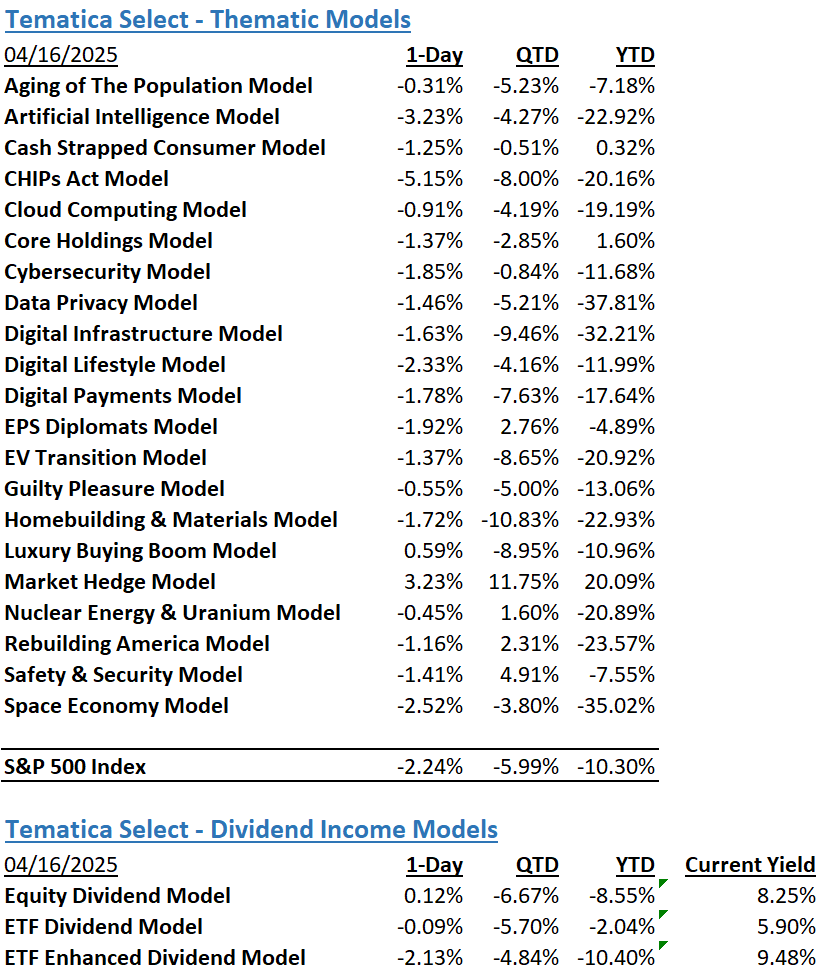

The Tematica Select Model Suite saw declines across the board except for Luxury Buying Boom. The biggest hits were taken by Space Economy, AI, and CHIPs Act. Still, we did see relative outperformance from several strategies, including Core Holdings, EPS Diplomats, Nuclear Energy & Uranium, and Guilty Pleasure to name a few. Once again, Market Hedge did its job, ending the day 3.23% higher and extending its YTD lead over the S&P 500 index to just over 30%.

Powell’s No Rate Cut Brings Trump Ire

Equity futures are mixed this morning with tech stock being lifted by the better-than-expected quarterly results and guidance from Taiwan Semiconductor (TSM). That included a 73.5% year-over-year increase in the company’s High-Performance Computing segment, which houses its data center and AI chips. Management reiterated expectations for revenue tied to AI accelerators to double this year, with overall revenue climbing near mid-20% for 2025. In a somewhat surprising move, TSM also issued longer-term guidance calling for its top line to grow at a mid-20% compound annual growth rate over the 2024-2029 period. That lines up rather well with multi-year AI and data center forecast and supports our AI and Digital Infrastructure models rather nicely.

That good news is being offset by the sharp pre-market drop in the shares of United Health (UNH), which missed March quarter results and updated its 2025 outlook well below market forecasts. Shares of homebuilder DR Horton (DHI) are also falling in pre-market trading as it also came up short for its March quarter and issued downside guidance for the balance of its fiscal year.

Those reports and others reaffirm our view the market will need to reset 2025 EPS expectations for the S&P 500. In turn, those EPS growth rate revisions are likely to spur renewed questions about proper P/E multiples for that market basket. For us, it’s simply another reason to keep some exposure to our Market Hedge model as we move deeper into the first third of the current earnings season.

Outside of quarterly earnings, in what should be a surprise to almost no one, President Trump is pushing back hard on Fed Chair Powell’s no rate cut likely comments. During his prepared remarks Powell shared

…the new Administration is in the process of implementing substantial policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. Those policies are still evolving, and their effects on the economy remain highly uncertain. As we learn more, we will continue to update our assessment. The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.

But it was what the Fed Chair said shortly thereafter that caught the market’s attention:

We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.

The bottom line is there is likely no “good news” rate cut coming anytime soon, and at least for now, a “bad news” rate cut doesn’t appear to be on the Fed’s radar screen. Knowing that will have us pay that much more attention to next week’s Flash April PMI data from S&P Global (SPGI). Powell’s comments also set up a potential showdown with Trump over rate cuts, something we flagged several weeks back. With Trump’s closing remark that “Powell’s termination cannot come fast enough!” we continue to see that on the horizon. While Trump may not like the Fed’s independence, Treasury Secretary Scott Bessent’s comment that Fed independence in deciding on monetary policy was a “jewel box that has got to be preserved” suggests Powell is likely to serve out the remainder of his term despite Trump’s bluster.

On the tariff and trade front, Trump is also touting “big progress” following Japan’s Trade Representative Akazawa meeting with US officials yesterday, including Trump himself. Given the meeting spanned a total of just over two hours, we’re not surprised they didn’t result in an immediate halt to the tariffs, but preparations are underway for a second round of talks to take place later this month. Later today, Italy’s Prime Minister Meloni will meet with Trump today to discuss trade, and we expect a similar outcome.

On the programming front, a quick reminder US equity markets are closed tomorrow for the Good Friday ahead of the Easter holiday. That means we’ll be suspending our usual weekend Signals email, picking things back up with Monday’s The Week Ahead.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.