Yesterday’s Market Wrap

While not as dependable as finding bagpipers at the Killarney Rose down the road from the NYSE at lunch on St. Patrick’s Day, equities had a second green day in a row. Volatility edged slightly lower as the Cboe Market Volatility Index (VIX) closed at 20.51, but gold saw its second-ever close above $3000/oz. This tells us that while US equities are starting to acclimate to the current climate, geopolitical volatility is still buoying the markets’ oldest hedge.

Leadership came from Small Caps as the Russell 2000 gained 1.19% and we saw that while avoiding tech was additive, everything ended higher. The Nasdaq Composite rose 0.31%, the S&P 500 added 0.64% and the Dow closed 0.86% higher. Looking at yesterday’s results of the SPDR S&P 500 ETF Trust (SPY) we saw 5 of 7 Mag 7 names fill slots in the top 10 detractors from performance but given the 459/44 advance decline line, there was enough weight in yesterday’s winners to overcome the losers. Top on the list of SPY winners yesterday were Berkshire Hathaway (BRK.B), Netflix (NFLX), and UnitedHealth Group Inc. (UNH).

Sectors were up across the board as well led by Real Estate (1.76%) and Energy (1.59%) with remaining segments posting gains ranging from 1.46% (Consumer Staples) to 0.16% (Consumer Discretionary). Similar to the broader market, the Consumer Discretionary saw gains despite Mag 7 names Amazon (AMZN) and Tesla (TSLA) being the top two detractors from sector returns.

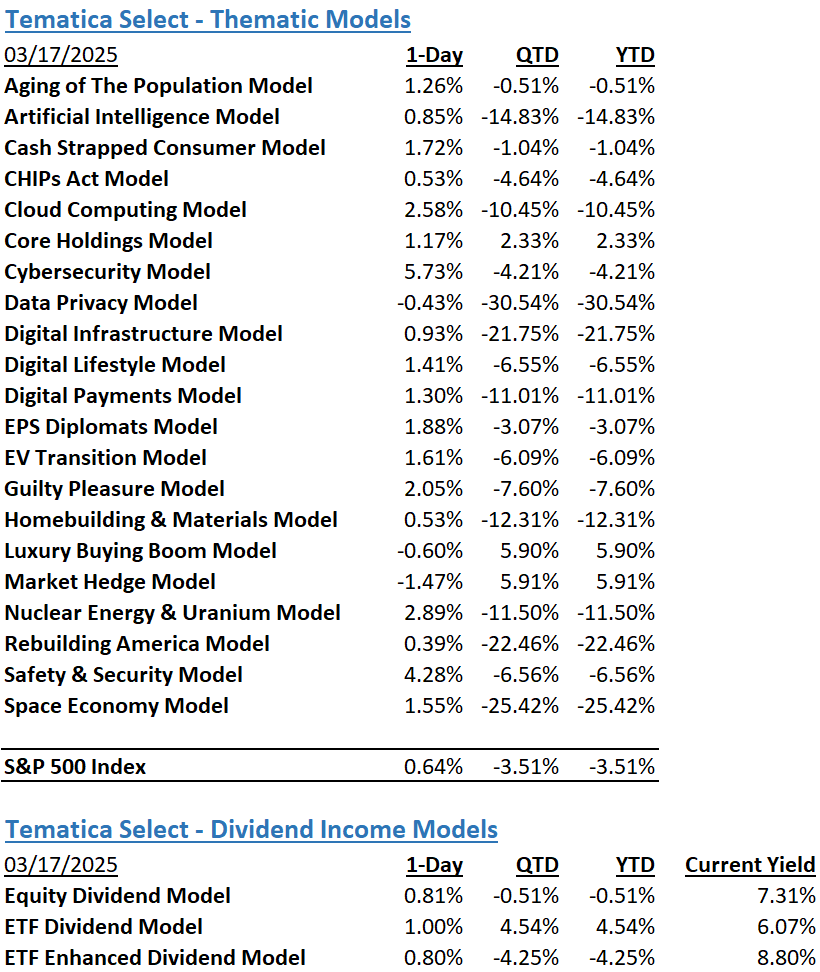

While Market Hedge is still the quarter-to-date returns winner in the Tematica Select Model Suite leaderboard it understandably took a backseat as the rest of the suite (except Data Privacy) advanced yesterday. An almost 60% rise in Arqit Quantum (ARQQ) helped Cybersecurity post a strong day. Strength also came from Safety & Security and Nuclear Energy & Uranium.

Trump and Nvidia Today, Tomorrow Brings the Fed

Following the first set of back-to-back gains in some time, futures point to equities giving some of that back when the stock market opens for trading later today. Because we only have a few pieces of fresh February data out this morning and no notable corporate earnings, we’re likely to see a bit of a lull until Nvidia (NVDA) CEO Jensen Huang delivers his GTC 2025 keynote address at 1 PM PT today. We will also be waiting to hear the outcome of President Trump’s conversation with Russian President Vladimir Putin to end the war with Ukraine.

Folks may reflect on reports Alphabet’s (GOOGL) Google is once again circling cybersecurity company Wiz for what could be the company’s largest acquisition. The thinking is Wiz’s enhanced security features that could help Google win more customers to its cloud service and accelerate the growth of that recurring revenue business.

Here comes the Fed

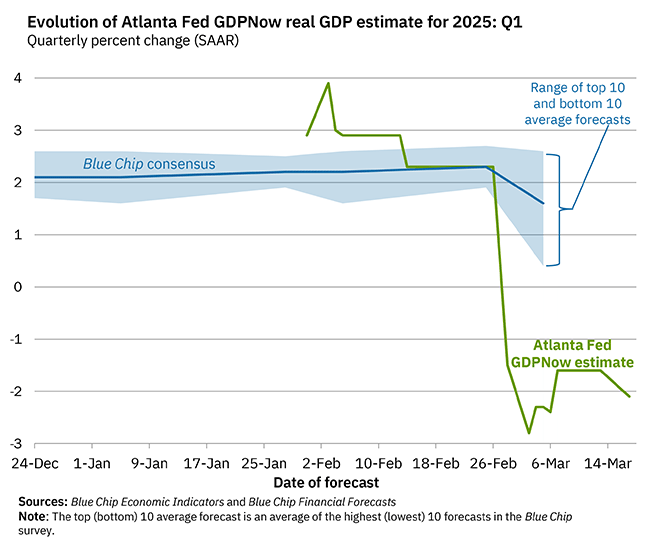

Ahead of tomorrow’s Fed policy decision and updated economic projections, we suspect folks will be looking at today’s update to the Atlanta Fed’s GDPNow model. Yesterday’s update of -2.1%, while a tad better than the prior -2.4% figure is still in the red. Should today’s update remain there, and we see little reason why today’s February Housing Starts and Industrial Production reports would trigger a jump into positive territory, we expect it will prompt several questions to Fed Chair Powell tomorrow afternoon. We think that because at his most recent appearance on March 8, he commented “The economy’s fine. It doesn’t need us to do anything, really.”

Based on other Powell comments from that day and what we’ve seen in the data, neither we nor Wall Street expect the Fed to deliver a rate cut tomorrow. Still, we will be mining the Fed’s policy statement Wednesday afternoon, its updated set of economic projections, and Powell’s presser comments to gauge how it now sees the vector and velocity of the economy, inflation pressures, and tariff risks. We suspect Powell will reiterate the Fed’s dual mandate and the flexibility it has to respond to incoming data.

However, given the price data contained in the February PMI reports, the upswing in consumer inflation expectations, plus past comments the Fed will want to see sustained progress toward the Fed’s 2% target, the likely message will be there is no rate cut on the near-term horizon. The latest look at the CME FedWatch tool shows the market factoring in another 25-basis point rate cut at the Fed’s June policy meeting and another one to two before the end of the year.

Back in December, the Fed’s set of economic projections showed two 25-basis point rate cuts on the table for this year. That was way before more recent pricing data and the start of Trump’s tariffs. Should next week’s projection updates show fewer cuts compared to December, that could take some wind out of the market.

Few earnings reports, but very much worth watching

While the volume of earnings reports coming at us will be much smaller than we’ve seen in recent weeks, we recognize comments from Darden Restaurants (DRI), FedEx (FDX), Micron (MU), and Nike (NKE) will be ones that influence expectations for the March-quarter earnings season. We’ll be focusing on demand and margin comments as well as what these companies say about inflation pressures and the impact of tariffs.

We’ll also look to see if they confirm our thinking about the risk of June-quarter guidance underwhelming Wall Street expectations. The same goes for any comments about 2025 expectations. That will see us revisit quarterly 2025 consensus EPS expectations for the S&P 500 from FactSet on Friday.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.