Market Recap

While a final death knell on America’s AAA credit rating was largely shrugged off by equity markets earlier this week, markets had a visceral reaction to a tough 20-year treasury auction that saw bonds price their way to 5.047% yesterday. In the span of 30 minutes between 1:00 pm and 1:30 pm, the S&P 500 fell just under 1.30% on its way to its closing 1.61% lower. The Nasdaq Composite fared slightly better, falling 1.41% and the Dow worse, closing 1.91% lower. Small caps took the brunt of sentiment as the Russell 2000 gave back 2.80%.

Unsurprisingly, sectors were all lower, led by Health Care (-2.65%), and Real Estate (-2.32%). The remaining sectors saw results ranging from -0.75% (Communication Services) to -2.05% (Financials). The Cboe Market Volatility Index(VIX)jumped up above 20 and gold perked up, closing at $3.313.90. Other indicators include a 20/483 advance-decline line for the holdings of the SPDR S&P 500 ETF Trust (SPY). Return leaders in the index included Alphabet (GOOG,GOOGL) with each share class closing close to 3% higher, and CME Group (CME) which added 1.39%.

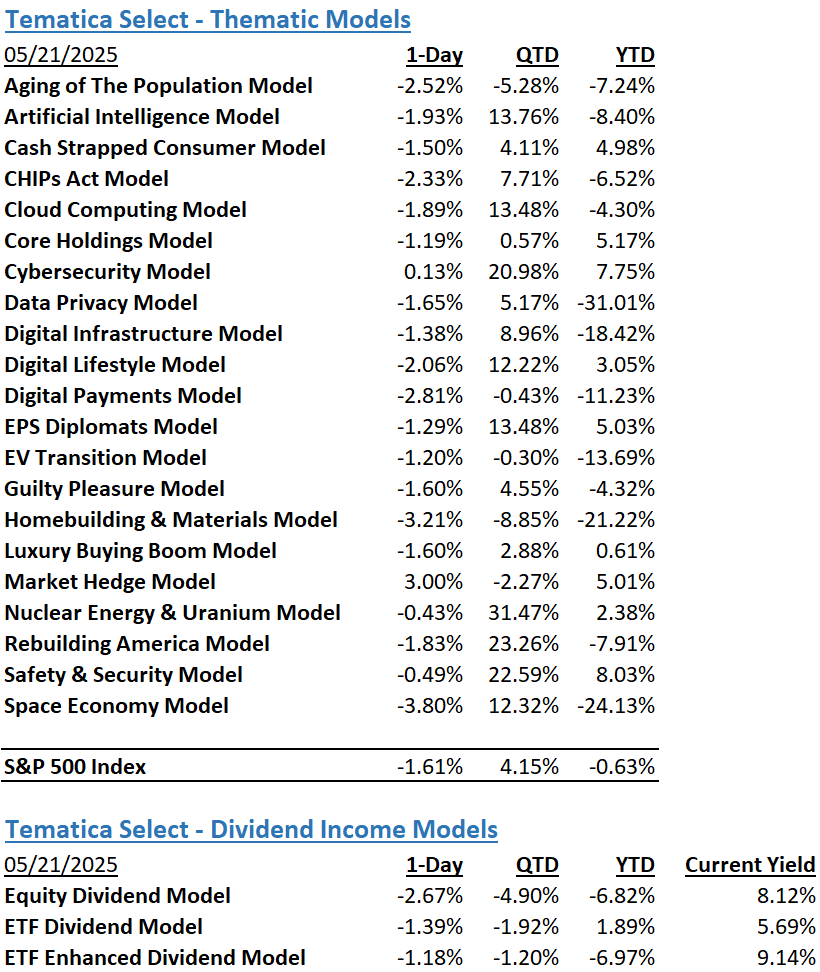

Except for Cybersecurity, the Tematica Select Model Suite had a tough day yesterday, led lower by Space Economy and Homebuilding & Materials. Relative strength came from Nuclear Energy & Uranium, Safety & Security, Core Holdings, and EPS Diplomats.

Trump’s Bill Moves to the Senate, Flash May PMI Data on Deck

Following the market’s move lower over the last few days, equity futures and Treasury yields are little changed as we approach today’s market open. We are reading the House passed a large reconciliation bill by a vote of 215-214, which includes an extension of 2017 tax cuts for all income levels, spending cuts for Medicaid and green energy spending, deregulation, energy reform, immigration reform, and a debt ceiling increase of $4 trillion. The more than 1,000-page bill now heads to the Senate where changes are expected but only a simple majority is needed to pass instead of the typical 60 votes required to move bills through the Senate.

While we take a wait-and-see approach for that bill as well as progress on Trump trade deals, the Flash May Composite PMI for the eurozone came in at 49.5, down from April’s 50.4 reading, hitting a 6-month low in the process. Per the report, “new orders have now decreased on a monthly basis throughout the past year. The latest decline in new business was modest, but the most pronounced since December 2024.” On the inflation front, “Manufacturing input costs decreased for the second consecutive month, and to the largest extent since March 2024. On the other hand, services input prices were up sharply again, with the pace of inflation slightly stronger than in April.”

That suggests tariffs are having only a modest impact, a sentiment shared by Amazon (AMZN) CEO Andy Jassy when he communicated the company hasn’t seen any meaningful reduction in consumer spending or an increase in prices as a result of tariffs introduced by US President Donald Trump earlier this year. That flies in the face of recent comments from Walmart (WMT), but the dueling views have us even more interested in what today’s Flash May PMI for the US will say when it’s published at 9:45 AM ET. The same report will also give us reason to revisit rolling central bank GDP forecasts for the current quarter that currently peg it growing at 2.3%-2.4%. The Flash May data will also lead us to closely parse the language from Fed speakers today and tomorrow but also from Fed Chair Powell over the weekend.

On the earnings docket this morning, we get another look at the consumer and retail land courtesy of BJ’s Wholesale(BJ), Ralph Lauren (RL), and Williams-Sonoma (WSM). Ross Stores (ROST), Deckers Outdoor (DECK), and Buckle (BKE) will round out that view this afternoon and tomorrow morning.

We also have a hotbed of investment banking activity today, both on the IPO and M&A front. Hinge Health (HNGE)priced its IPO of 13.7 million shares at $32, the high end of the targeted $28-$32 range. MNTN Inc. (MNTN) sold 11.7 million shares in its IPO at $16, also the upper end of the targeted $14-$16 range. Folks will want to gauge the post offerings reception of these deals and if they perform even close to what we’ve seen with the recent IPO from CoreWeave (CRWV), up 168% since the shares debuted, we may be on the cusp of a more vibrant IPO market.

On the M&A front, AT&T (T) clinched a deal to acquire Lumen Technologies’ (LUMN) consumer fiber operations for $5.75 billion in cash, UK chemicals company Johnson Matthey has agreed to sell its catalyst technologies business to Honeywell (HON), and Sanofi (SNY) will acquire Vigil Neuroscience, a clinical-stage biotech company in a $470 million deal.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.