C8 Monthly Update – December 2019

Do you still need to invest in a hedge fund for liquid strategies?

We believe that the best solution for an asset owner is to use the C8 platform to trade the underlying instruments. However, we appreciate that not everyone has the trading infrastructure needed to do that. In this case, an Actively Managed Certificate (AMC) might be the future. These are low-cost (from 30bp) onshore structures that are listed on major stock exchanges, with segregated assets to remove counterparty risk. Any C8 Index or combination of Indices can be used as a basis for the Certificate. The first of which is:

Cirdan Capital to Issue an Actively Managed Certificate Based on the C8/GreenBlue Good Governance L/S Index.

Since the launch in June (see that month’s Update), there has been substantial interest in the C8/GreenBlue Good Governance L/S Index. In particular, this index matches investment demand for high quality ESG products in the wealth management sector. Cirdan Capital has agreed to launch an Actively Managed Certificate that will allow clients of private banks and wealth managers to hold the Certificates in their own accounts. Cirdan Capital is a UK Finance Boutique, regulated by the FCA, that will launch the Certificate from their Luxembourg Securitised Vehicle, Aldburg SA. Aldburg is structured with segregated compartments so that the Certificate avoids counterparty risk:

• The Certificate will be called the ‘C8/GreenBlue – Good Governance US Equity L/S Certificate 2027’.

• It will be listed on the Frankfurt Stock Exchange on 6 January, with a 2 week subscription period until 20 January.

• The Certificate is available to all professional, HNW and institutional investors outside the US.

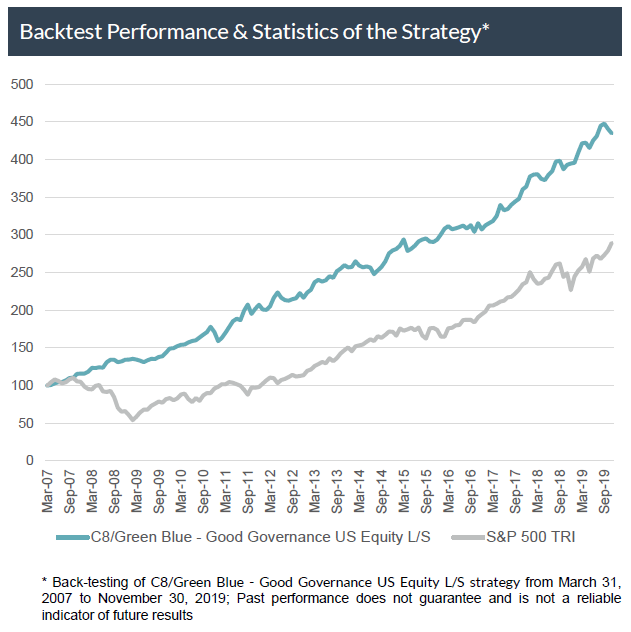

• Below is the back-tested performance from Cirdan’s Certificate presentation:

As a reminder, the Good Governance L/S Index combines C8’s systematic capabilities, using a factor-based, long/short model, with Green Blue Invest’s Good Governance Strategy. The stock selection is based on a proprietary methodology developed by Prof Cossin at IMD Business School in Lausanne, using natural language processing of S&P500 companies’ annual accounts. Prof Cossin is a world-renowned expert on good corporate governance.

If you are interested in knowing more on the Good Governance Long/Short Index we would be delighted to help, whilst we can pass any enquiries about the Certificate itself to Cirdan Capital. Importantly, this process can be replicated by Cirdan to create, on demand, a Certificate based on any Index or combination of Indices available on the C8 platform.

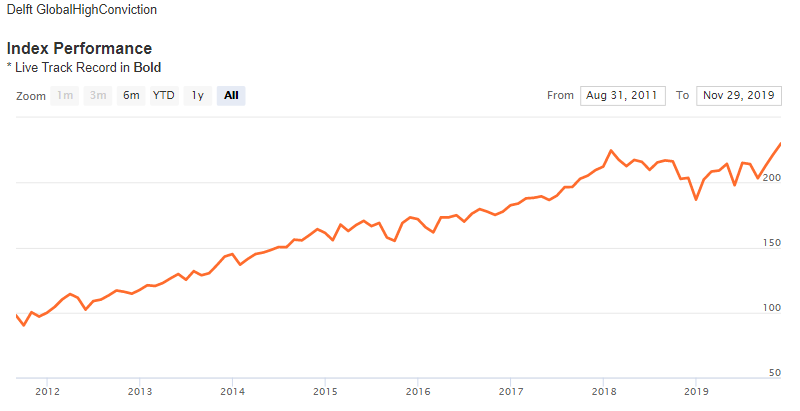

Delft Partners Join the C8 Platform

Take some of the world’s most experienced equity managers, Robert Swift, the former CIO of Putnam Investments ($200bio AUM) and Kevin Smith, the former CIO for equities for ABN Amro Asset Management ($100bio AUM), and combine that with a VMQ Model (Value, Quality and Momentum), developed in conjunction with Karl Hunt, the former Head of Global Quantitative Investment Management at the sovereign wealth fund, ADIA. Their combined effort produces long-term highly-focused equity portfolios. That is the investment philosophy behind Delft Partners, so we are understandably excited to add their three equity portfolios to C8 Studio.

Delft’s investment process selects stocks and builds portfolios by combining their quantitative stock analysis model with the team’s extensive fundamental equity and market knowledge. On the C8 platform can now be found a long-only unconstrained Global High Conviction Equity Index, a Global Infrastructure Equity Index , and an Asia Small Companies Equity Index. More information on Delft is available at:

Delft Partners Website

By accessing these portfolios on C8’s Direct Indexing Platform, an asset owner can now track the performance of these equity portfolios by simply trading the underlying equities.

Delft Global High Conviction Index

C8 Studio – The Next Generation II – Combining C8 Indices Using Mixed Integer Optimisation

Our clients typically chooses a set of C8 Tradeable Indices that could add returns and diversification into their investment portfolio. The question is how best to combine these indices. C8 Studio now includes an advanced option to use ‘quadratic optimisation with an integer constraint’.

We start with a super-set of C8 Indices (the client’s selection) from which a subset of Indices is rebalanced at regular intervals, with the results used, out of sample, in the following period (ie a typical ‘walk forward’ analysis). It is easiest to illustrate this with an example:

• A client wishes to add some alternative risk premia (ARP) to their portfolio

• They look at 20 separate Indices that would be suitable

• They rebalance once every 12 months and look to use between 4 and 10 Indices at any one time

• They can also constrain the solution to allow a maximum allocation of, say, 25% to any one index

To solve this mean/ variance problem, first calculate a ‘robust’ covariance matrix. With small data sets, data outliers can distort the correlation analysis, so a ‘robust’ matrix is calculated by removing those outliers from the sample.

The next major issue is choosing the best 4 – 10 Indices at any rebalancing. This is achieved with cardinality constraints that turn a linear optimization into a combinatorial optimisation problem. Clearly, there are a large number of potential solutions (the best of any 10 out of 20, or any 9 out of 20, or any 8 out of 20, etc) for which efficient methods exist to solve this.

Rebalancing, say every 12 months, and then running the portfolio of Indices out of sample generates the return stream for the combined Index, whilst the solution is also adjusted to a target volatility level.

This combined C8 Index can then be added into the client’s investment portfolio. Our analysis suggests that, as in this example, adding alternative risk premia to a typical equity/bond portfolio can improve the portfolio’s risk/ return, even when the C8 Indices have a relatively low overall weighting, of 10-20%.

Using this Function in C8 Studio

Whilst this is an advanced technique, using this function is straightforward:

• Select the list of Indices that you might want to incorporate (they can be given a maximum or minimum weight).

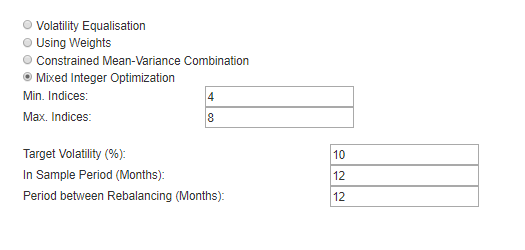

• Select Mixed Integer Optimisation (see screenshot below).

• Choose the minimum to maximum number of indices that you would like to use at any one time

• Select the initial sample period (typically 12 months)

• Select the period between rebalancing (eg 12 months)

The process will run in the background and be available on the Available Indices page when completed.

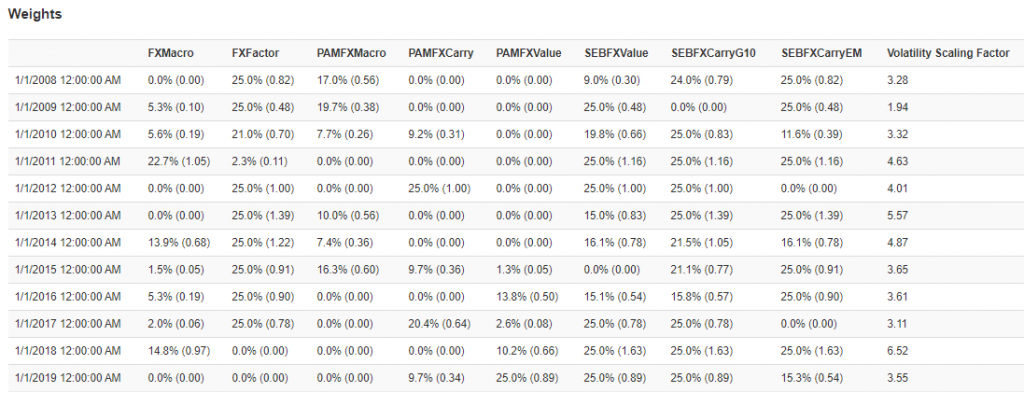

Using the platform’s 8 FX Indices as an example, the weights below show how the mixed integer optimisation would have weighted the Indices over the past 10 years. This is a walk- forward analysis so that the index weights are only used to track future performance, in contrast to traditional back-testing techniques.

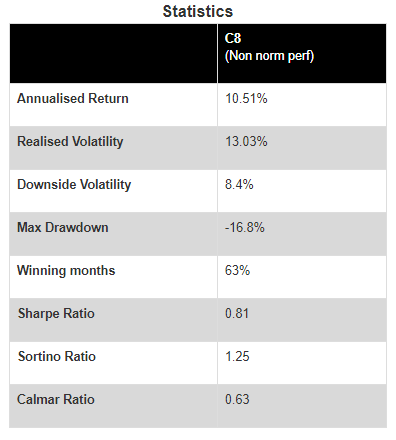

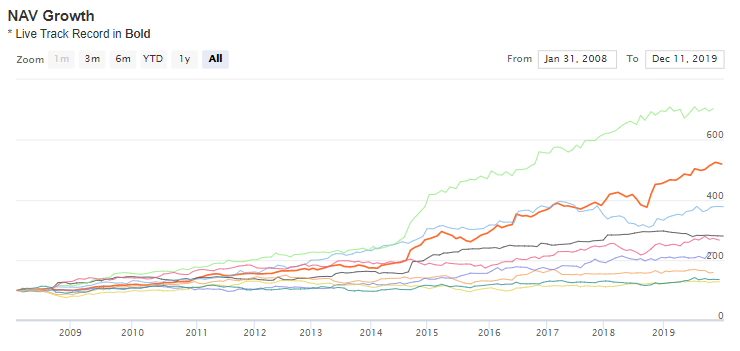

The performance of the walk-forward weighting process is shown below:

On request, we would be happy to give a web demonstration of these new combining techniques which add a powerful new tool to C8 Studio.

This is the last Update of the year, so we would like to take this opportunity to wish you all a happy and prosperous 2020!

Thanks for reading,

The C8 Team

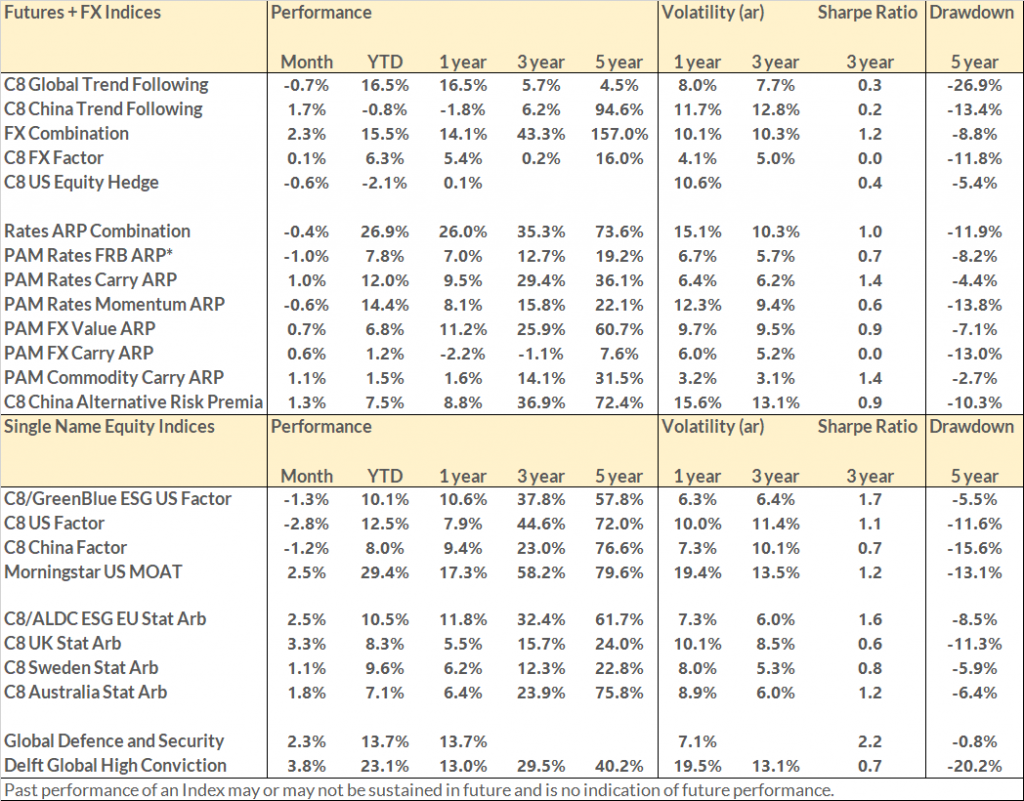

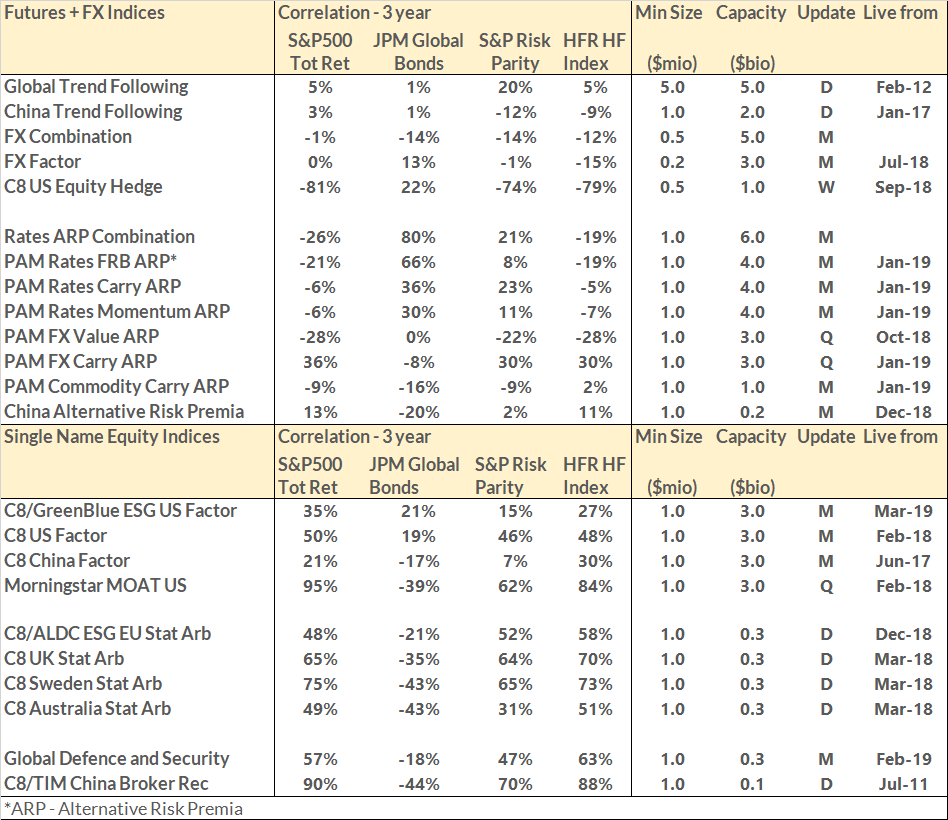

November Performance

FX indices have been one of the strongest performers of the year, and it had another strong month in November. Rates risk premia were broadly flat after giving back some the gains after some exceptional quarters. Equities were mixed with the Stat Arb Indices performing well but the factor models correcting after recent advances.