C8 Monthly Update – October 2019 |

|

|

The C8 platform now offers access to our Chinese Indices from outside China, and our non-Chinese Indices from China. |

|

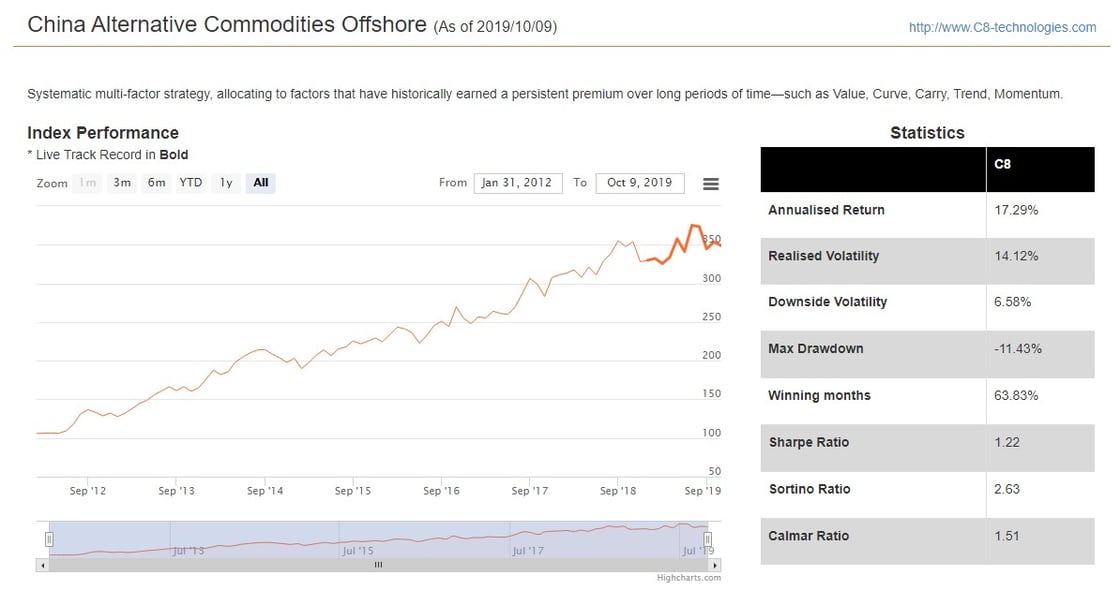

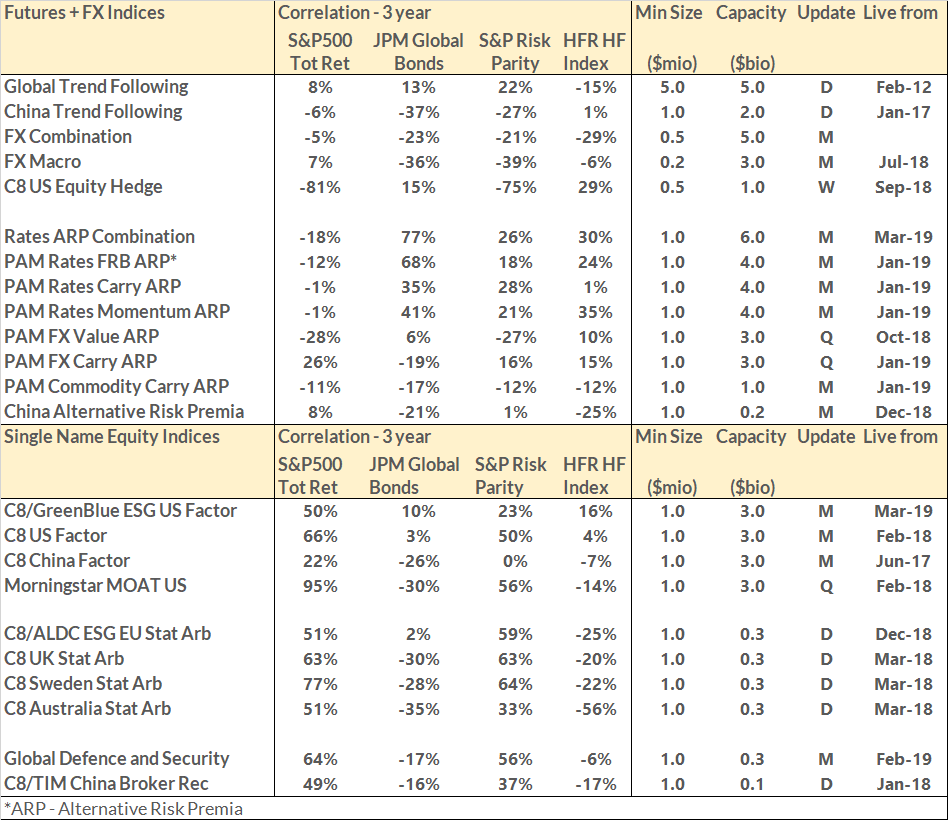

We are excited to announce that our Chinese clients can now track our Indices outside of China, whilst our non-Chinese clients can access our Indices in China. Whilst it has become easier to trade Chinese equities from outside China, the futures market is still closed. However, the C8 platform has established a link between our C8 Shanghai office via CICC, one of the largest Chinese brokers, who can swap returns between their Hong Kong and Shanghai branches. A good example of an Index that is now available outside China is the C8 Alternative Risk Premia Index based on the Chinese commodity futures markets (see performance below). There is always a search for new Risk Premia, and we introduced our proprietary C8/ GreenBlue ‘Good Governance’ premia in our June Update. With this Hong Kong/ Shanghai link now in place, another uncorrelated risk premia is available to our clients. There are some additional costs in using the swap, but even taking those into account, our Chinese commodity risk premium, which is trading live in China (see the bold line), would still generate a historical 1.2 Sharpe ratio. |

|

|

So how does the cross-border trading work? Using the C8 platform the trades are sent to CICC’s Hong Kong branch which are then traded by their Shanghai branch. The resulting p/l is swapped between the two branches. This p/l is then swapped via a Total Return Swap to the client’s broker account. Voila! In the opposite direction, we have Chinese clients looking to track external Indices, in particular, Risk Premia Indices. The trade flows just runs in the opposite direction, with C8 platform generating orders that can be sent to the CICC’s Shanghai branch, that are then executed from Hong Kong. |

|

|

C8 Studio – The Next Generation – A sneak preview |

|

In the next few weeks there will be a major upgrade to C8 Studio, which will add some exciting new functionality. The most important development is to put our most advanced Index combining tools onto the platform. We will focus on these powerful tools next month, but, for now, here is a taster of the some of the other upgrades. First up is a new screening tool, where, for example, the rolling correlation of a selection of Indices can be viewed in graphical form (see example below). |

|

|

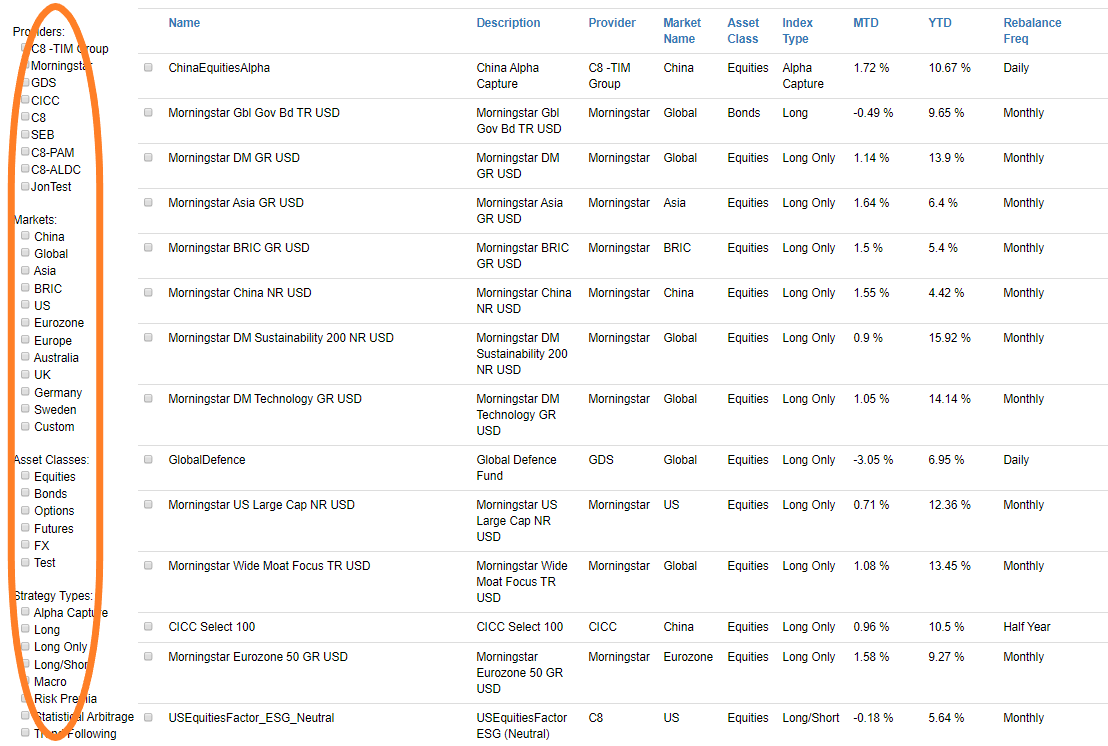

As the number of Active Tradeable Indices continues to grow on the platform, we have introduced a more powerful filtering tool to sort by provider, asset class, style etc (see below). |

|

|

Finally, not all Indices are created equal, so with the new release it will now be possible to view any or all the Indices with their volatility normalised to 10%, to make it easier to compare performance. In addition, any benchmark index will be normalised to the same volatility as the C8 Tradable Index. |

|

|

Next month, C8 will be presenting ‘The C8 Way’ at the Morningstar Investment Conferences in Milan, Madrid and Paris |

|

Further to our collaboration with Morningstar, we would be delighted if you could join us at one of the upcoming Morningstar conferences. We would love to see you there and present our unique Direct Indexing platform. Apart from C8, we note that at each conference there are some great panels and speakers on the agenda, including speakers from Amundi, Robeco, H2O, M&G, Newton, Unigestion and PIMCO, to name just a few (full agenda is in the links). If you are interested in attending, please select your chosen city and follow the links below to register. |

|

|

|

|

|

Thanks for reading, The C8 Team |

|

|

September PerformanceSeptember saw a reversal of the August stock market drop and rates markets finally corrected from their bumper rally of 2019. These diverse moves were also observed on the C8 platform, with our Rates Alternative Risk Premia (ARP) combination down 3% on the month, though still up a strong 25% on the year. Our Stat Arb models performed well in the equity space whilst the FX Combo rose a further 3% and is now up 16% ytd. In commodities, our China ARP continues to perform well. In trend following, there was a large divergence in performance, with the Global Index up 3% (14% ytd) but a sharp trend reversal in Chinese futures took this Index down 7%. |

|

|

|

|

|

|

| C8 Technologies, Michelin House, 81 Fulham Road, London, Greater London SW3 6RD, +44 (0) 20 3826 0045 |

|