C8 Weekly Bulletin: Backing Value over Defensive – NDR’s Smart Sector07 February 2023 |

|

January’s 6.2% advance in the US S&P500 index was far from uniform with sector performances stretching from a 15% gain in consumer discretionary to a 2% retreat in utilities. Given the importance of sectoral positioning – alongside overall market-directional bets – this week we give the opportunity to our index provider, Ned Davis Research, to outline the big calls from its ‘Dan Hagen/ NDR Smart Sector with Catastrophic Stop’ strategy. Dan Hagen/ NDR Smart Sector AllocationSnapshot of January Sector Returns |

|

|

As we enter February, the sector model has continued to overweight Value areas such as Energy, Materials, and Financials, as well as added more Growth-oriented Technology to its overweights. Real Estate also moved to a slight overweight. The prior month’s significant underweights in Consumer Discretionary and Communication Services were neutralized. Defensive sectors such as Consumer Staples, Health Care, and Utilities were recommended underweights, as well as cyclically-oriented Industrials. |

|

Among this month’s sector weighting upgrades; Technology – to overweight from marketweight: External measures like valuation, relative short interest, and performance of Emerging Asia equities continued to be bullish for the sector. The model’s improvement was driven purely by technicals. Real estate – to slight overweight from modest underweight: Conflicting fundamental factors but the sector’s short-term relative price reversal moved to a bullish reading. Financials sector – steady weighting improvement since August extended into February; now significant overweight: Economic surprises, bank loan growth, an attractive valuation, and a slight improvement in the yield curve have all supported strong technicals. This past month, narrowing spreads for IG Financials joined the list of bullish indicators. |

Dan Hagen/ NDR Catastrophic Stop Overlay |

|

|

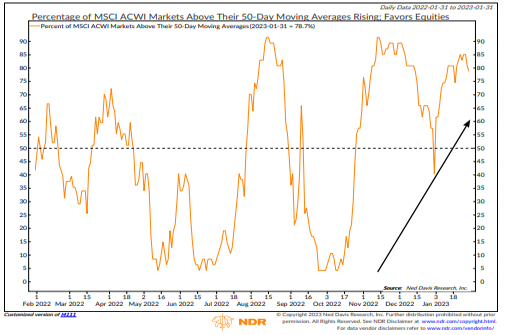

The Dan Hagen/ NDR Catastrophic Sell Stop model combines time-tested, objective indicators designed to identify high risk periods for the equity market, to add downside protection to the index. The model currently has a fully invested equity allocation recommendation, as the composite score improved toward end-January. Stronger breadth measures drove the model improvement. The percentage of global equity markets above their 50-day moving average rose to 85%, well above the 50% positive threshold for the model (see chart above). Amongst external influences, HY and EM bond breadth improved, which was offset by extremely optimistic, short-term stock market sentiment. |

|

NDR Updates on C8 Knowledge Hub The recent NDR updates can be viewed in C8 Studio, under Resources > Knowledge Hub: Day Hagan/NDR Smart Sector® with Catastrophic Stop Strategy February 2023 Update |