Market Recap

Equities finally took a breather yesterday as the S&P 500 index failed to extend its 9 days of consecutive gains. Mag 7 and technology were a net drag on broad equity indexes as the Dow fell 0.24%, the S&P 500 declined 0.64%, and the Nasdaq Composite gave back 0.74%. Small caps led the way lower, shedding 0.82%. The advance/decline line for holdings of the SPDR S&P 500 ETF Trust (SPY) was 189/314, with Mag 7 names Apple (AAPL), Amazon (AMZN), Tesla (TSLA), and Nvidia (NVDA) contributing to just about 60% of the fund’s 0.57% decline. Filling out an additional 3 slots in the top ten detractors from performance were Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP) as the energy sector fell 1.81% on news of plans by OPEC+ to raise production quotas.

Communication Services (0.24%) and Industrials (0.05%) were the only positive sectors. Video game makers Take-Two (TTWO) and Electronic Arts (EA) combined to contribute to just over 100% of Communication Services results, helping offset losses from movie studios and streaming services following the weekend proclamation of 100% tariffs on non-US produced movies.

Gold ticked higher to $3,310.10/oz and the Cboe Market Volatility Index gained about a point to see 23.64 a the close, more manageable than April’s 30-handle prints but again, still higher than the traditional mid-teens long-term average for this measure. OPEC+ production adds put further pressure on crude prices, sending West Texas Intermediate Crude(WTI) to $57.19/bbl and Brent Light Sweet Crude (BRENT) to $60.32/bbl.

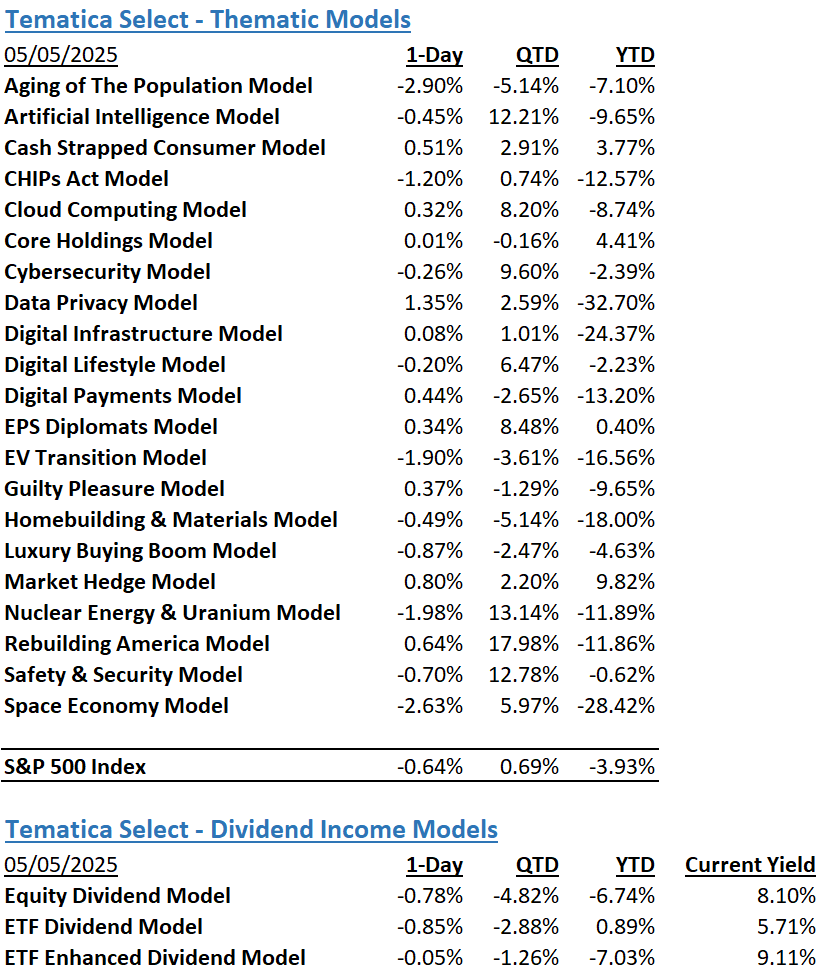

The Tematica Select Model Suite saw mixed results yesterday. Market Hedge posted gains, but so did a number of other models, with suite leadership coming from Data Privacy, with positive results coming from Rebuilding America, Cash Strapped Consumer, and Digital Payments, among others. Laggards included EV Transition and Space Economy. Latest monthly updates on the models can be found here.

Tariffs Continue to Take Their Toll as We Wait for the Fed

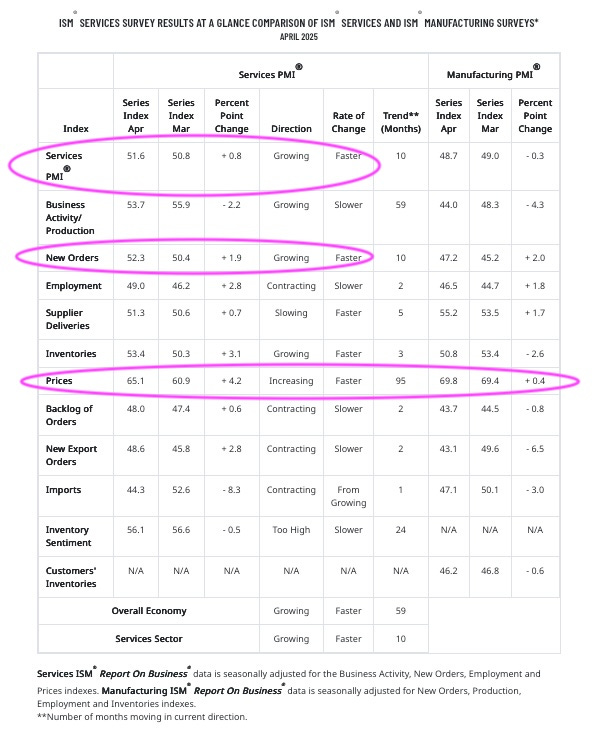

Stock futures point to a lower open when equities begin trading today. With no market-moving economic data being released this morning and no Fed speakers, the drivers of the market will be reactions to quarterly results last night and this morning, and anything new on the tariff and trade front. That said, we are once again in a bit of a holding pattern ahead of tomorrow’s Fed policy meeting outcome. Like most others, we do not expect the Fed to deliver a rate cut exiting that meeting. Unlike many others, we expect Fed Chair Powell to deliver some sobering comments about the prospect of rate cuts in 2H 2025. Bolstering our view for that is recent April data that showed the US economy continues to grow, albeit at a slightly slower pace, and inflation pressure perked up during the month. The culprit – tariffs.

We saw the impact of tariffs in quarterly results last night from Ford Motor (F). While the company bested market expectations for its March quarter, Ford was the latest to join the growing list of those suspending their guidance. It also shared expectations to take a $1.5 billion hit this year due to, you guessed it, tariffs. Ford also discussed “the potential for industrywide supply chain disruption impacting production”. We’re hearing more and more about this, especially when it comes to falling port and airfreight traffic from Asia.

While it may not be as severe as it was during the pandemic, we are expecting certain sectors of the market, like retail, to face supply shortages. That, paired with the impact of higher costs due to tariffs, suggests we should brace for higher prices in the coming days and weeks. At the same time, signs that the consumer is becoming increasingly selective in their spending continue.

Following the company’s quarterly results that sent its shares reeling, Block (XYZ) CEO Jack Dorsey said there was a pronounced shift in consumer behavior this year. “This coincided with inflows coming in below our expectations. During the quarter, non-discretionary CashApp Card spend in areas like grocery and gas was more resilient, while we saw a more pronounced impact on discretionary spending in areas like travel and media. We believe this consumer softness was a key driver of our forecast miss.” This speaks to our Cash-Strapped Consumer model, but it’s also another reason to be wary as the current earnings season shifts to retail-facing companies. It will also have us eyeing results and guidance from Uber UBER), Walt Disney (DIS), and Tapestry (TRP) this week, as well as those from Walmart (WMT), Kohl’s (KSS), Target (TGT), and others in the coming ones.

Getting back to tariffs, we can add comments from President Trump yesterday that he will announce pharmaceutical-specific tariffs within the next two weeks. For some context, data from EY found that in 2023 alone, the U.S. imported $203 billion in pharmaceutical products, with 73% coming from Europe, primarily Ireland, Germany, and Switzerland. While the argument is for the reshoring of capacity, it may not take as much time as it will for auto manufacturers, but it will still take time.

We are also seeing shares of Wall Street darling Palantir (PLTR) move lower this morning following just in-line March quarter results. While the company lifted its full-year outlook for this year, it’s fair to say the in-line quarterly results underwhelmed folks following the more than 60% year-to-date move in the shares. There were positives to be noted, including Palantir’s US commercial revenue growing meaningfully faster (+71%), which addressed questions over its reach beyond its US government business. Revenue growth of 45% at that segment, which accounted for 42% of total revenue in the quarter, pushed back on DOGE-related concerns. Also, we see Palantir’s 39% year-over-year jump in customer count and the US commercial bookings rising 183% year-over-year to $810 million, telegraphing that AI adoption continues. Good news for our AI model, but also our Digital Infrastructure one as well.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.